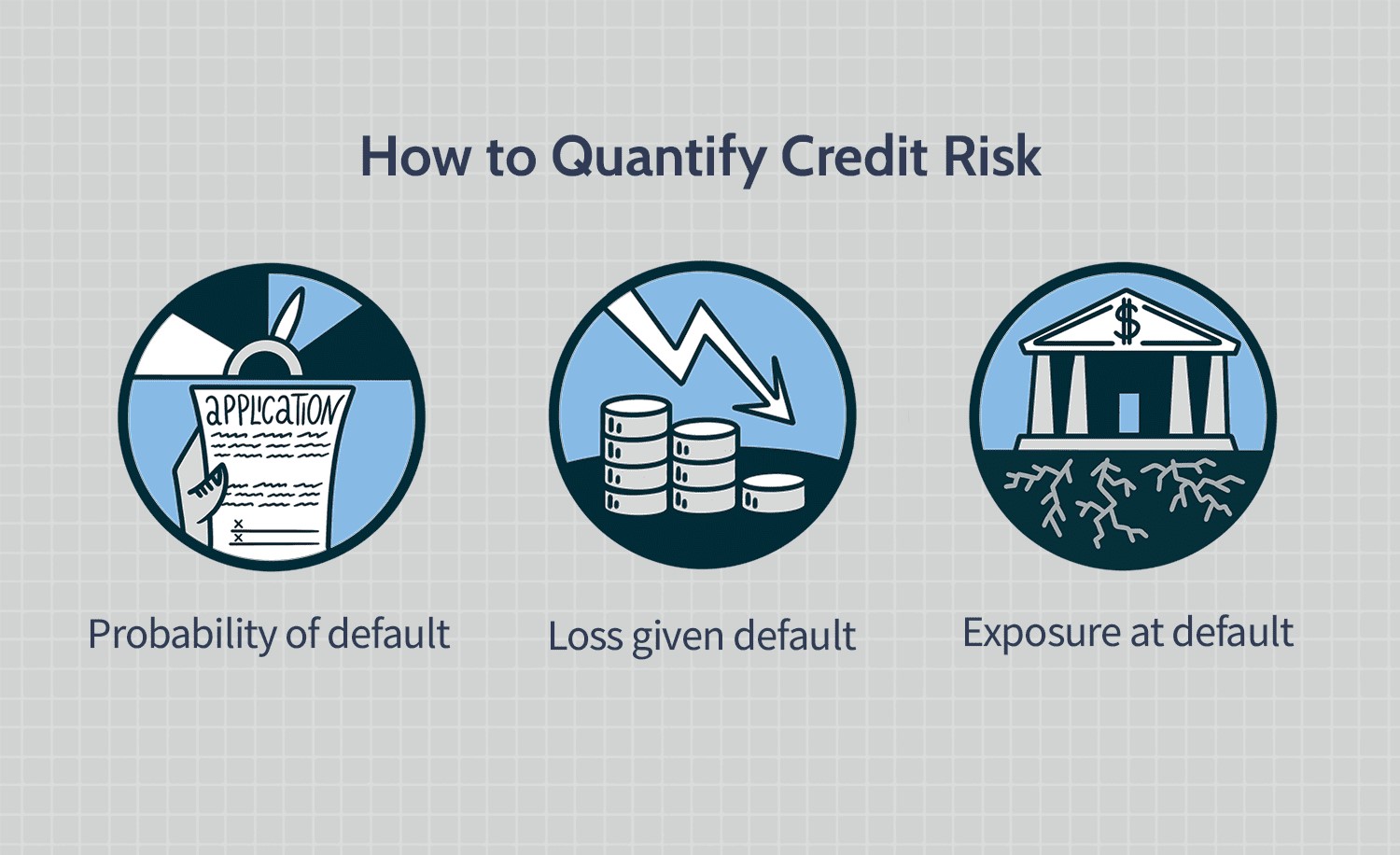

Project Overview

This project aims to understand and predict the likelihood of loan defaults in Home Credit's lending operations using advanced machine learning techniques. By analyzing historical data on loan applicants' repayment patterns, the project seeks to identify key factors that contribute to default risks. Ultimately, the goal is to develop a predictive model that can help Home Credit make more informed lending decisions, reduce financial losses due to defaults, and improve access to credit for underserved populations.

The dataset utilized in this project, obtained from Home Credit, consists of extensive information on loan applicants, including financial history and personal details. Methodologies involved data preprocessing, feature engineering, and model development, employing techniques such as imputation for missing data, transformation of skewed variables, and the application of machine learning algorithms like Random Forest and XGBoost for predictive modeling. These approaches aim to extract valuable insights from the data and build robust models capable of accurately predicting the likelihood of loan defaults, thus aiding Home Credit in making informed lending decisions.